Manage Finance

Small businesses must focus on financial management to ensure long-term success. Effective financial management can improve cash flow, aid in decision making, ensure regulatory compliance, and increase profitability. Without proper financial management, small businesses may face cash flow issues, missed opportunities, and even business failure.

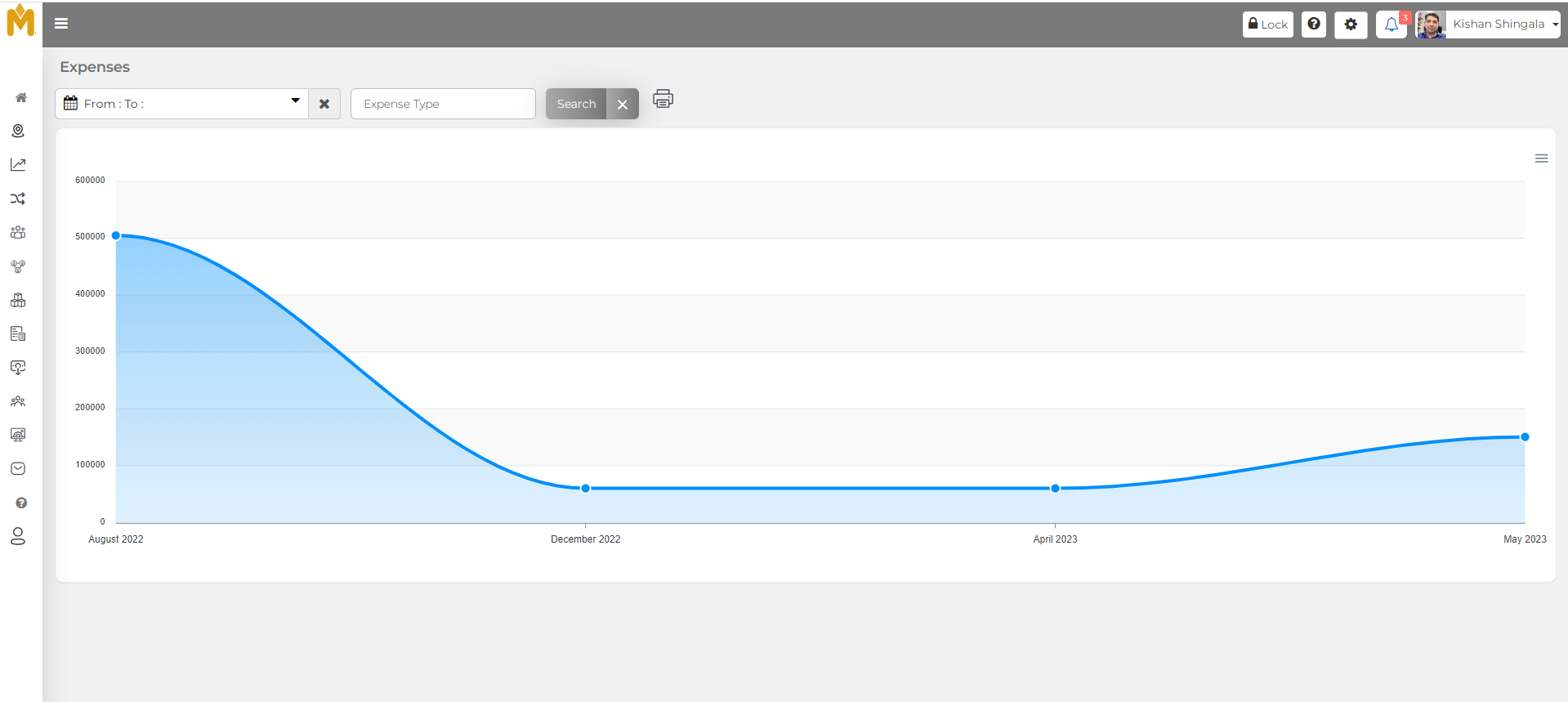

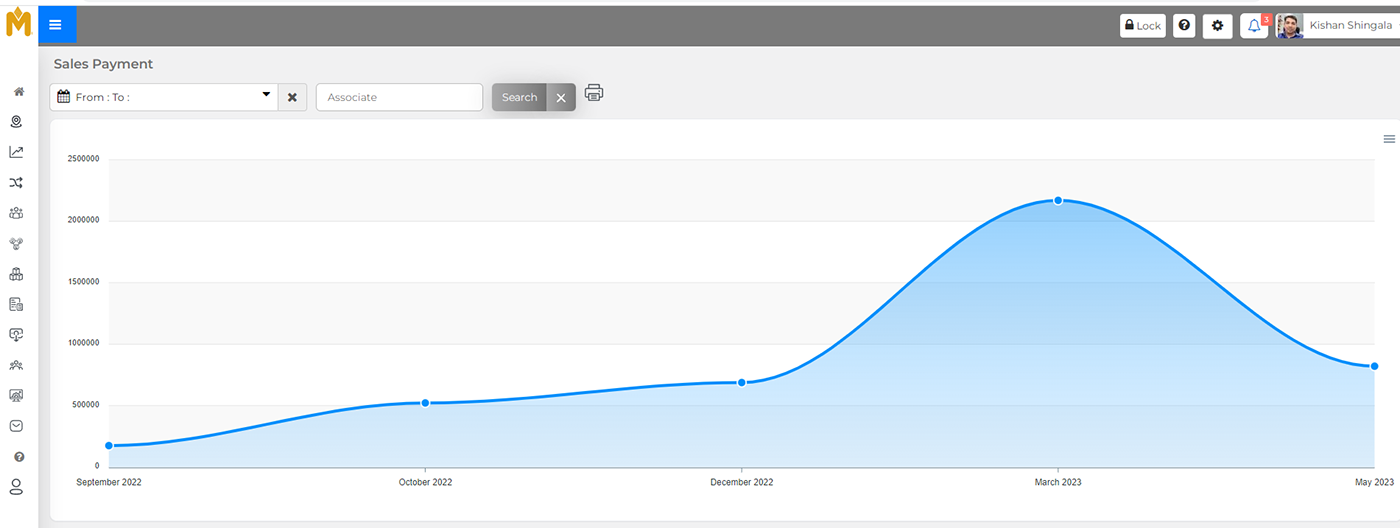

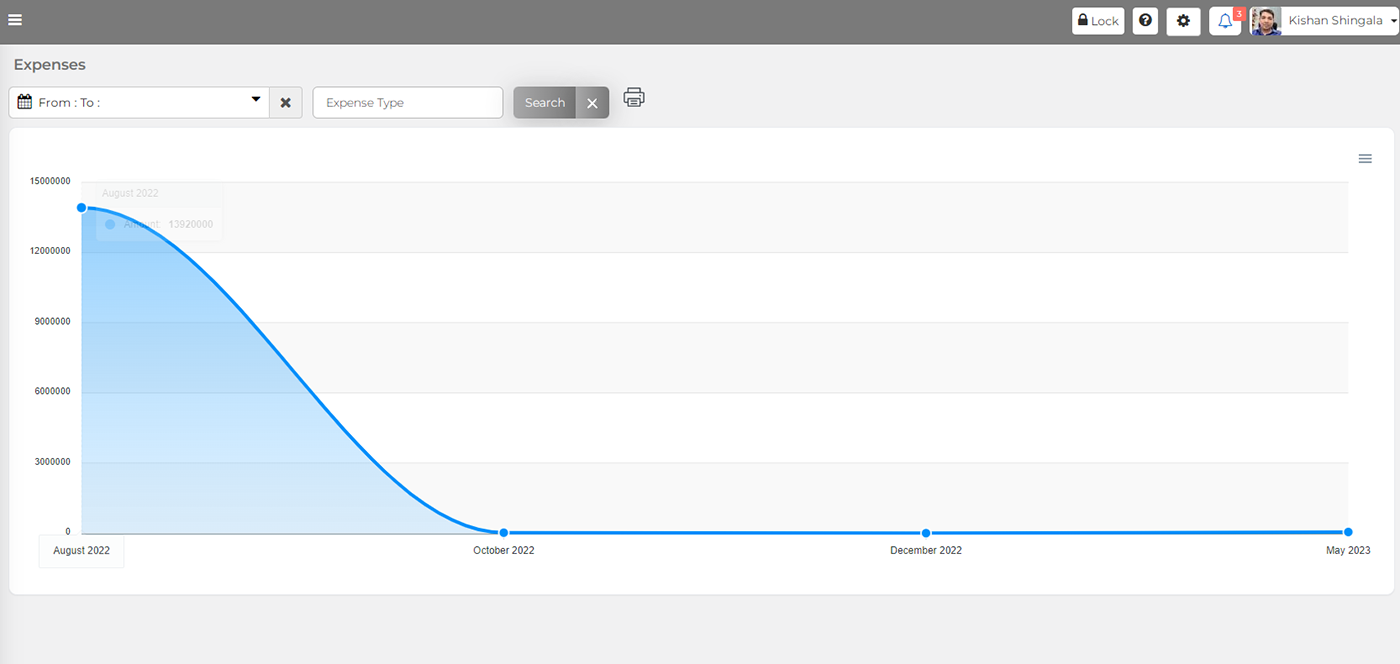

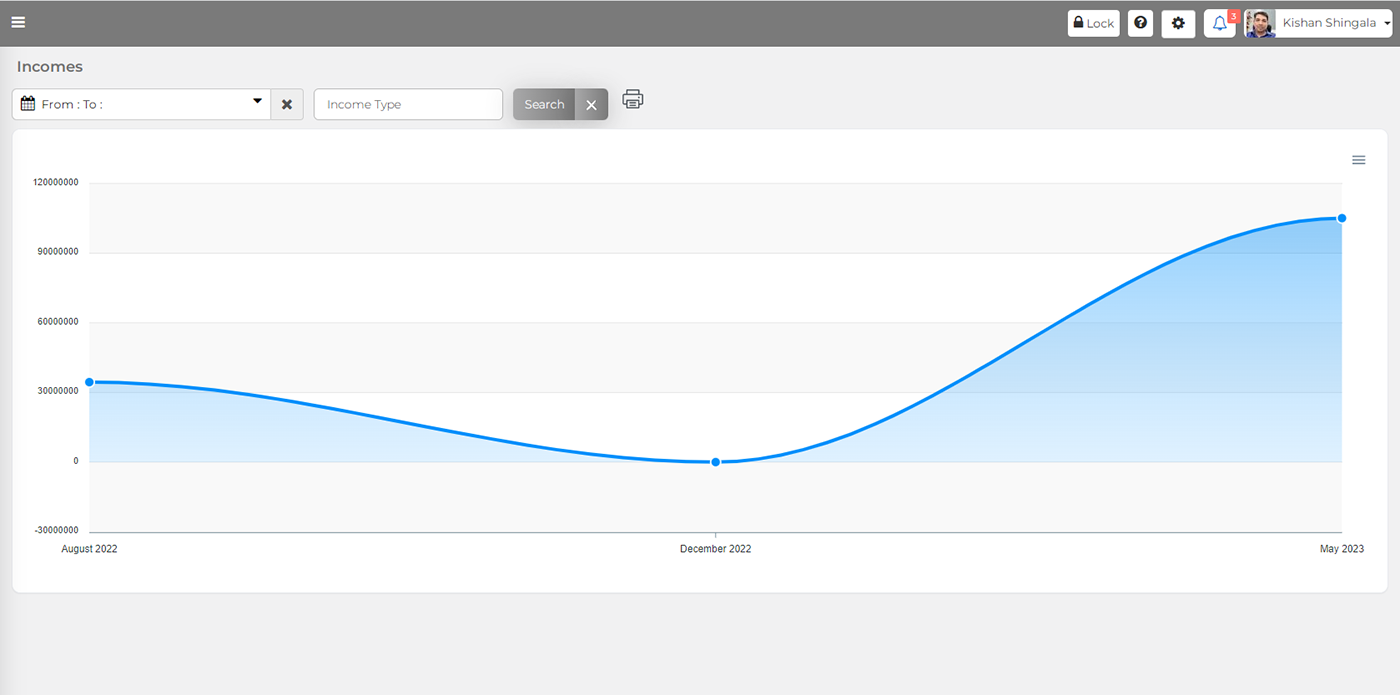

Effective financial management can help small shops maintain a healthy cash flow by tracking expenses and revenues, and identifying areas where costs can be reduced.

By tracking financial data, small shop owners can make informed decisions about pricing, inventory, and other key aspects of their business.

By optimizing financial management, small shops can increase profitability and invest in growth opportunities.

Capabilities

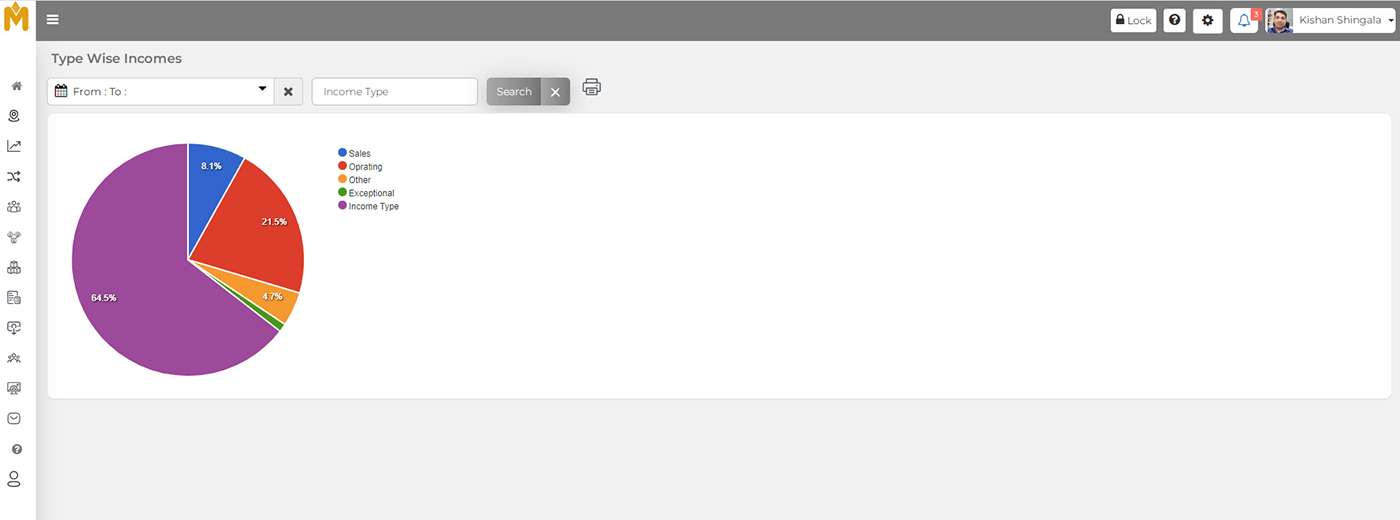

Expense/Income Management

Owner can effectively keep track of all incomes and expenses.

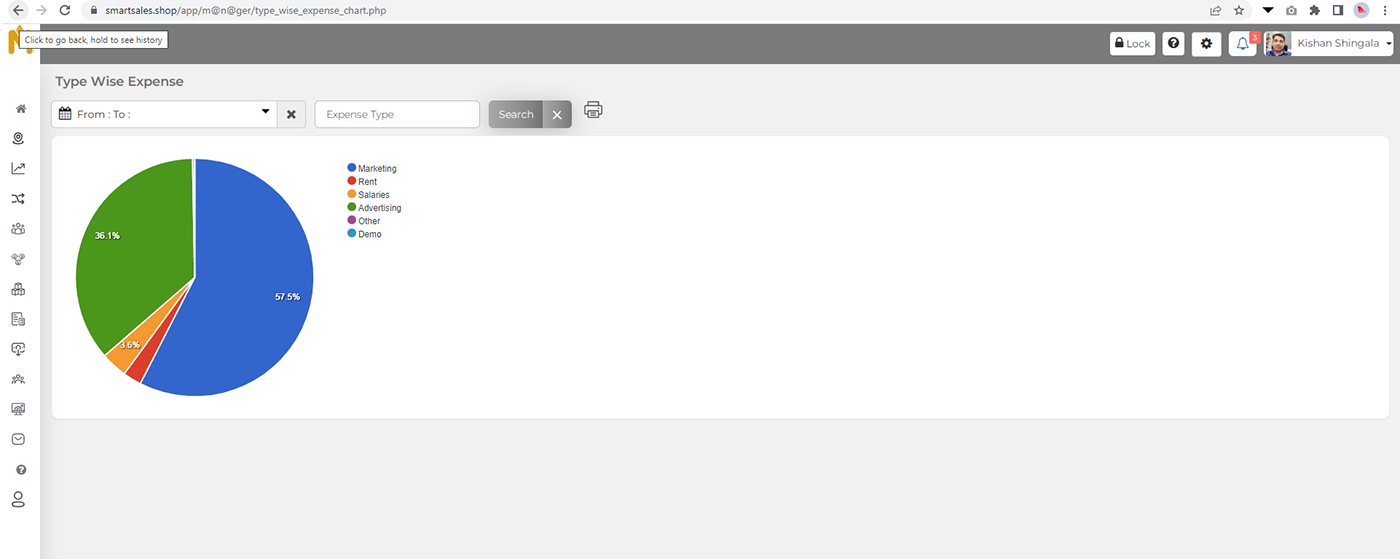

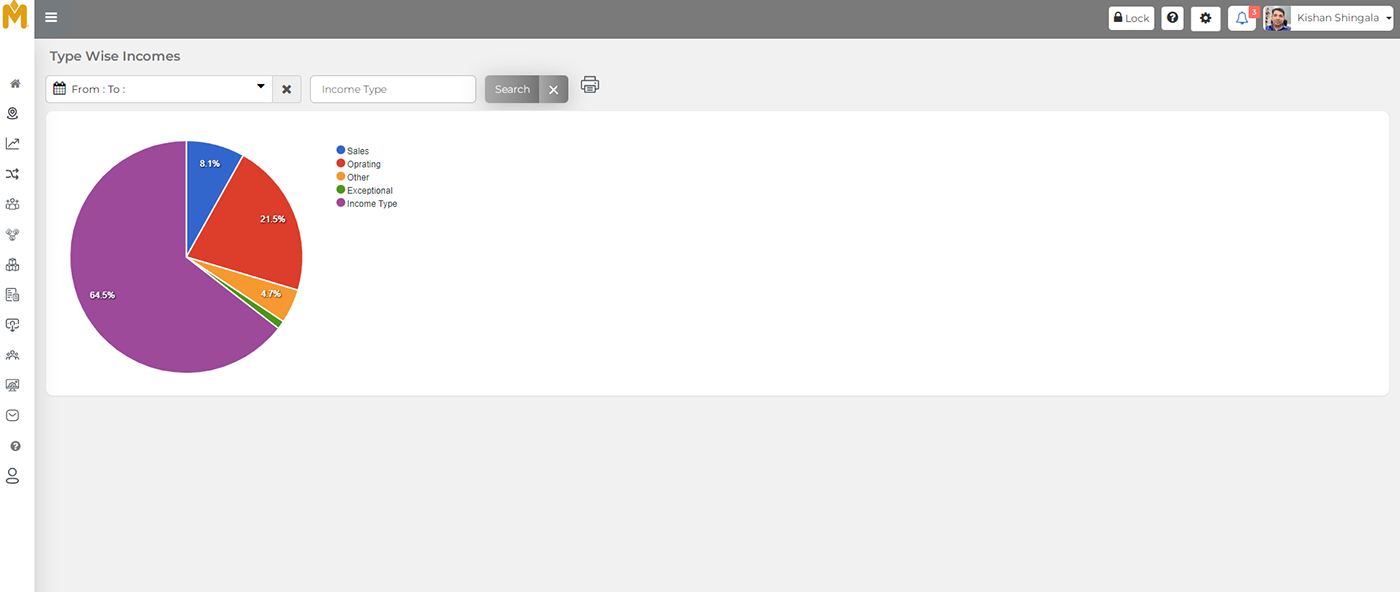

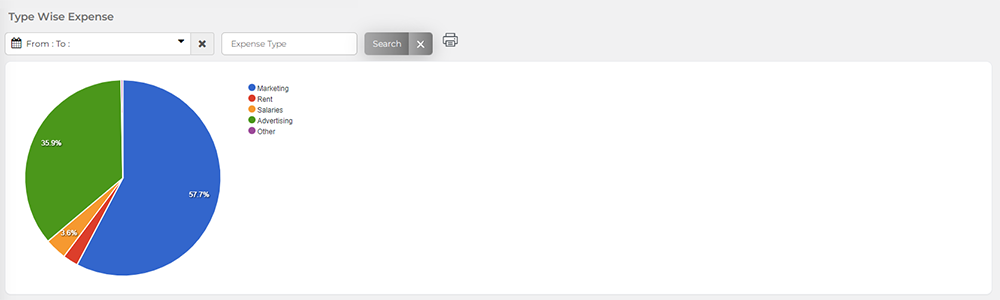

Financial Analysis

Businesses can conduct financial analysis to identify areas where costs can be reduced or revenues can be increased.